One of the core principles of marketing is getting to know the consumer to better understand their needs. While this still poses a challenge, many tools can help a business gain the most from their insight marketing. Case in point, the main subject of this article: Conjoint Analysis.

Defining Conjoint Analysis: Utility in Research & Production

Conjoint analysis is a method by which companies can gather information about how buyers make decisions. It gathers information about customer preferences by often (but not always) using choices, hypotheticals, product attributes, etc., and cross-analyzing the responses to understand the factors influencing purchase intention.

It can serve as a means of conducting a customer feedback analysis or serve as the basis for fostering good product design and process improvements. Aside from improving marketing messaging, it allows a company to better understand and fulfil customer needs. It places an emphasis on customer value analysis, deriving an accurate picture of what attributes and USPs people value the most.

As a needs-based customer analysis model, it differs from others by combining real-life scenarios and statistical techniques. The advantages of market research in this style include:

- It directly involves the customers and identifies their purchase decision factors.

- Can identify the core customer values and differentiate them from secondary and tertiary appeals.

- Allows for comparative preference evaluations based on different product profiles while identifying what trade-offs customers would make in their buying behaviour. This can also lead to an optimal product presentation or be used for future R&D.

There are many types of conjoint analysis but this article is covering two main ones: CBC & ACA.

Choice-Based Conjoint Analysis (CBC)

A popular type of conjoint analysis, since it emulates the decision-making process with choices. This sort of inquiry can yield useful data especially when part of a customer needs analysis. CBC uses full profiles of different products and thus can be more time-consuming for respondents.

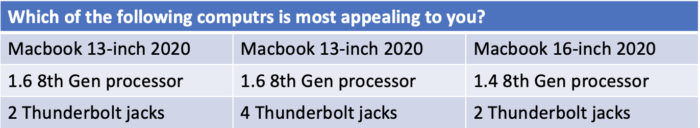

A CBC analysis may employ two or more options for consumers to choose from, with slight variations. Take, for example, the simplified choice table below:

The slight variations in the product can reveal the most preferable options and give insight into what trade-offs the consumer is willing to make. Similarly, it can be arranged along demographic or psychographic against each other if the questions are being answered by different groups.

Adaptive Conjoint Analysis (ACA)

The adaptive conjoint analysis deals more with the direct product attributes being measured. As a method, it avoids overloading the respondents with too many choices when the number of attributes exceeds what could be effectively answered with more traditional methods. It focuses on just a few attributes at a time, particularly those that are most important to respondents.

ACA is considered weak concerning testing price but is quite formidable at ranking different attributes. ACA, as the name suggests, adapts each questionnaire for the specific respondent. Researchers can do this through software analysis, where a program learns enough about each respondent’s values to focus on those areas of importance to that respondent.

While CBC and ACA questions are similar, ACA takes more in-depth data about customers into account. The method weighs previous answers as it goes along and allows for an adaptive style. Different software can adapt future questions automatically. The primary benefit of this method is that it is less time-intensive for the respondents.

Creating a Market Research Panel

To obtain a decent customer behaviour analysis, marketers first need a representative panel. While there are several ways to go about this, the choice depends heavily on the purpose behind the analysis. For example, a company that is just starting up can not create a panel from existing customers. This is especially true if they are looking to expand their market.

Companies that have stagnated may want to analyze why their products are not selling in other markets. In this case, they may want to ask why their competitors are doing better. For example, a rival soda company may want to inquire why customers prefer Coca-Cola to their product. They could thus set up a panel representative of their rival’s market and ask them to identify which factors are most important to their purchasing decision.

You could always use tools like Survey Monkey or certain mass email tools to send out questionnaires. Oftentimes, the best way to collect emails like these can be through mailing lists from companies. Similarly, the length of the panel is also a consideration. Decide whether you want one-off surveys or a lengthy period of tests with the respondents.

Conjoint Analysis Sample Size

Ordinarily, a conjoint analysis uses surveys. The application of quantitative techniques in marketing allows for measuring across larger sample sizes, which can be particularly useful in deriving representative data. The number of respondents necessary for deriving useful customer feedback data can also depend on how niche or mass-market the product is.

A general rule of thumb is to keep the minimum sample size at 200 respondents. The more diverse the target group, the bigger the sample size needs to be. If you aim to divide it into 2 sub-groups, you may need a minimum sample size of 400 (200 of each). This is based largely on statistical benchmarks at a 5% margin of error (depending on the size of the population).

Populations have different sizes so it’s best to consult a statistician. Alternatively, you can use a sample size calculator. There are many free ones you can find via Google.

Researching Purchase Intention Factors

One of the advantages of conjoint analysis over other types of questions is that it can be more discreet in deriving answers. In CBC, companies can compare products through choice, rather than asking questions about rating preferences. This yields more comparative data and puts the customer in a situation where they have to make a choice, thus better simulating their buying behaviour.

Common product attribute examples include price, packaging, performance specs, and just about anything else consumers find important. These can be highly dependent on the nature of the product but generally testing for size, appearance, and performance can be a good place to start.

Digital marketers can learn a lot about online purchase decision-making processes by using conjoint analysis. With the use of discreet target groups, they may be able to make their A/B testing even more powerful. Imagine having reliable data on the most important aspects of consumer interest to create targeted advertising.

Conjoint Analysis Software

Qualtrics and Sawtooth are both very useful adaptive conjoint analysis software. With these tools, you may not even have to learn how to calculate relative importance in conjoint analysis. They can handle things like attribute weights for ACA all on their own.

These software/programs are better for conjoint analysis because they specialize in it. They have dedicated methodologies saved into the platform for easy use. They also contain extensive guides on their respective websites.

One can, however, use Google forms or other survey software with a little bit of ingenuity. They aren’t dedicated to complex surveying tasks and can be far cheaper. On the other hand, calculations such as those necessary for ACA can become a bit daunting.

If you’re interested in other marketing research services, you can visit our services section for more info.