A lot of flashy terms get bandied about on the Internet when it comes to tech circles. While many technologies come and go, very few become time-tested favourites whose popularity leaks into multiple industries. In recent years, none of these innovations has procured a more messianic allure than blockchain and its abilities to bring about a glorious new era of decentralised finance.

Is the technology all it’s cracked up to be? In this article, we want to cut through both the detractors and the hype machine and give you the facts on this (often daunting) tech craze.

Blockchain is part of a lot of different categories of technologies due to its multi-functionality. This, in turn, makes the conversation around it rather muddled. To simplify these broad categories, we’ll mostly focus on blockchain technology as a decentralised finance tool, even though it has been used for everything from anti-piracy to digital ID.

This article will serve as a basic explainer for the various generations of cryptocurrencies and blockchain in the fintech market.

Blockchain Structured Finance

Blockchain’s history has lots of gaps in it. Originally, it was modelled for its modern use by a person or group sporting the sobriquet “Satoshi Nakamoto”. The technology has been around a while before, but only later did it take on this new purpose. It’s fitting that a technology centred around decentralisation and anonymity would have such mysterious origins.

The technology existed since the ’90s but had never been put to such elaborate use till the 2010s, when it became the basis for Bitcoin trade. While it is primarily known for its uses in bookkeeping for cryptocurrency, the technology has seen wider uses in recent years.

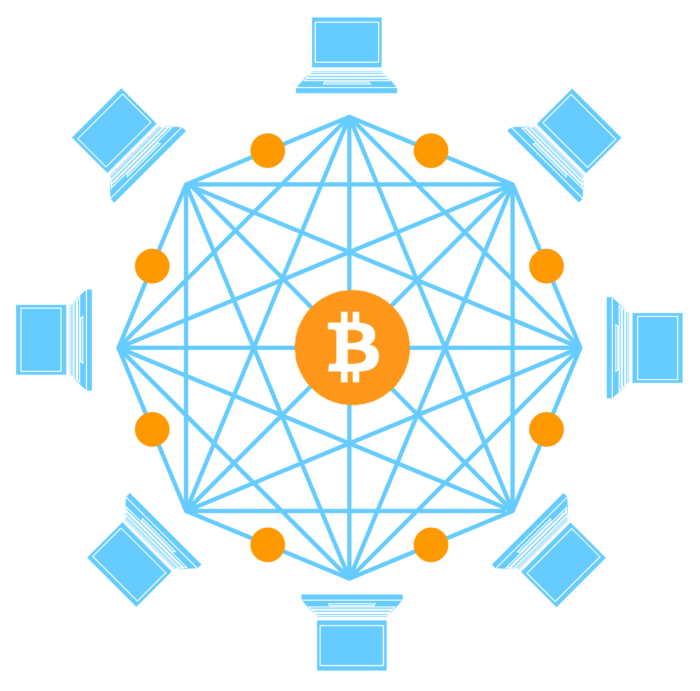

The basic premise of blockchain is that it connects multiple nodes into a shared “ledger”. Here all transactions are easily trackable and traceable within the network. Such a system minimises inaccuracies in bookkeeping and sends out signals instantly. The transparency it provides is useful in keeping all transactions in line.

As the name suggests, it sets up a “chain of blocks” where each block holds timestamped digital data. This data is not just its own, but also its previous blocks’ unique identity, known as a hash.

Decentralised Finance

Decentralized Finance (DeFi) or Open Finance makes use of smart contracts allowed by relatively recent variants of blockchain and cryptocurrency tech. By using these tools, it can create alternative, decentralised financial systems. Its biggest proponents tout its ability to make savings, loans, trading, insurance and safer, more accessible, and more transparent.

As the name implies, the system employs a mode of operation without a central authority. Though it may be difficult for some to imagine, the programs and algorithms operate in such a way so as to allow for banking without a central bank as mediator or insurance transactions without the need of a company in the middle. Automated systems will instead manage the admin and keep everything in the straight and narrow.

“Smart contracts” refer to programs that operate using blockchain. These execute automatically when certain criteria are fulfilled, thus running on autonomous protocols. Such contracts allow for far more sophisticated functionality outside of cryptocurrency exchanges.

These programs became the basis for decentralized apps (or dapps). In effect, such autonomous systems could allow users to negotiate contracts, loans, and other financial activities with no mediator other than the technology. Such a system would regulate against any foul play, prevent unwanted changes, and protect proceedings from outside parties.

Similarly, Blockchain can connect ERP (Enterprise Resource Planning) software with other applications. ERP integration allows for a superior level of data sharing across systems to improve productivity and insights while providing a prime source of info validity. It is very useful for businesses in keeping track of resources and data.

More on how blockchain operates and maintains such transactions in the sections below.

Blockchain & DLT

Decentralised finance relies heavily on distributed ledgers and blockchain. Sidenote: there is a distinction between Distributed Ledger Technology (DLT) and Blockchain, despite their overlap. The main difference is that DLTs do not have to use an open system where anyone can join. The public features in DLTs are either non-existent or severely limited.

DLTs can be more opaque in their operations than blockchains, but still offer a lot of access and ease of use. Other forms of decentralised technologies are more open to the public. DLTs would be more useful for companies or client relations and other direct interaction channels that necessitate more discretion.

Despite the inherent transparency, blockchain technologies also keep data secure and private. As blockchain is mostly automated publicly by the people who have strict access to it, it maintains constant feedback with other nodes in the chain. There is little to no interference external to the system.

The system creates a lot of reference points as it operates. This ensures that every node can constantly verify data, ensuring minimal errors or foul play. As a peer-to-peer system, it can present a decentralised alternative to other forms of transaction.

Cryptocurrency & Exchange Software Operations

As mentioned previously, cryptocurrency is the most popular use for blockchain. This begs the question: how does such a system create currency and mine it? As a digital currency, bitcoin and other types of electronic monetary exchange products are a string of numbers.

Due to their stand-alone numeric nature, they are not tied to any material assets like gold or silver. They also don’t have any essential physical representation (although some digital currencies can be made physically on request). They are also self-regulated within their own network.

As they don’t have a centralised authority monitoring each transaction, cryptocurrency operations work slightly differently. Every computer within the blockchain is part of the link and updates the entire ledger to ensure the validity of transactions. Computers add themselves to the block by mining Bitcoins as they solve complex functions and formulas. Each of these entries amends the ledger going forward, recalibrating the data in every node. These mining activities can take up quite some computing power.

This video by the New York Times explains the concept in detail:

Basically, each computer in the network is racing to solve a complex math puzzle and earn cryptocurrencies in return. The first one to solve these calculations establishes the official, accurate ledger. The complex puzzles each node in the blockchain is solving get more complex as more blocks are added. This ensures that the competition stays fair between all the entrants in the blockchain.

One thing to keep in mind is that there have been some major changes in how cryptocurrencies operate.

Basic Blockchain Terminology

As mentioned previously, blockchain jargon can be daunting for outsiders. One can find themselves lost, wondering “What is a Staking Calculator?” or a Cryptocurrency portfolio or blockchain testing. Luckily, we’re here to answer some of these more nebulous terms.

These terms can be crucial in understanding Blockchain and for learning how to trade Bitcoin for beginners.

- Bitcoin vs. Cryptocurrency: While occasionally used interchangeably in common parlance, these are not the same. A bitcoin is a very specific type of 1st-gen cryptocurrency, therefore all bitcoins are cryptocurrency but not all cryptocurrencies are bitcoins.

- Node: Any distributed IT system contains a series of independent computers, known as nodes. Nodes communicate with each other over a network with no particular one being the central node.

- Asymmetrical cryptography: Asymmetric cryptography, aka public-key cryptography, is one of the foundations of blockchain defi. It utilises a pair of related keys: one public key and one private key. These keys allow it to securely encrypt and decrypt messages and protect it from unauthorized access or use.

- Consensus algorithms: processes used to achieve agreement on a single piece of information among distributed processes or systems. Consensus algorithms are designed to achieve reliability in a network involving multiple unreliable parties.

- Proof-of-work: A type of consensus mechanism. Here, miners use their computing power to solve a mathematical puzzle in order to participate in the block validation process.

- Proof-of-stake: In proof-of-stake consensus mechanisms, miners are granted the right to validate blocks. By providing some of the currency they already possess, they can add a block to the chain.

- Proof-of-authority: In this setup, a set of authority nodes have the ability to create new blocks and secure the blockchain. The majority of these nodes sign off on the chain, after which it can become a part of the permanent record.

Cryptocurrency-specific Terms

- Mining: The process which allows new nodes into the system in a proof-of-work setup.

- Wallet: A storage location for digital assets that have an address for sending and receiving funds. The wallet can be online, offline, or on a physical device.

- Cold Wallet: An offline wallet that is not connected to the Internet. Consequently, this makes them safe from hacking, such as physical storage media.

- Cryptocurrency Portfolio: A software that helps manage the entire inventory of online investments. Depending on the software, they contain a variety of tools that help you analyse performance of the currencies in question.

- ICO: Initial Coin Offering refers to an early offer for a cryptocurrency buy-in. Interested investors can purchase offerings and receive a new cryptocurrency token issued by the company.

- Staking: the process of actively participating in transaction validation (similar to mining) on a proof-of-stake (PoS) blockchain. While on these blockchains, anyone with the minimum-entry balance of a specific cryptocurrency can validate transactions and earn Staking rewards.

- Staking Calculator: Staking calculators identify the value of your Bitcoin stake with regard to changes in time and worth of the cryptocurrency. For example, if someone wants to know if ada staking will be worth it over 3 years at a value of 15% increase per annum, the calculator will retrieve the value they could potentially have.

Cryptocurrency Exchange Developments

Cryptocurrency has gone through several advancements over the course of its existence. Mainly, experts divide these developments into 3 generations. The original technology was cumbersome in many ways, with later developments providing more efficient mining systems.

The first generation of blockchain and defi platforms work in the same manner as we outlined above. However, these systems had drawbacks like the massive use of computing power and lack of functionality beyond tracking ledgers. Second generation cryptocurrencies like Ethereum improved on these points along with transaction speeds.

The main issue with the first generation of blockchain was the complexity of the process. Originally, the calculations that form the basis of Bitcoin mining were too cumbersome for most computers. Bitcoin, for example, held a 1 in 16 trillion odds of successful mining. This made the creation and transmission of cryptocurrency far slower.

The next generation built on this and made things faster. While 2nd-gen cryptos were still not processing quickly enough to compete with payment mediums like Visa and PayPal, they were a step above. This hurdle was holding blockchain back from being a major player in the fintech market.

With blockchain 2.0, the technology shifted to other decentralised applications. This can be seen in technologies like Ethereum, where the blockchain’s multi-functionality is a crucial draw. Elements like smart contracts made it a promising technology (more on that later).

Blockchain 3.0

The 3rd generation of decentralised ledgers was a major step forward. It dealt with a lot of the concerns about currency transaction security and how to boost Bitcoin mining speeds. This time around, the scalability issues were the focus of the improvements.

Previous generations of the technology operated with high block time, referencing the amount of time it takes for information to create the next block within the chain. In context, Bitcoin took 10 minutes to set up a block and Ethereum took 20 seconds. 3rd generation currency ledgers like Ada Cardano do it essentially in real-time.

This breakneck speed comes courtesy of the DAG (Directed Acyclic Graph) system newer cryptocurrencies use. These systems can vary based on the specifics of each currency but one thing remains the same: they are acyclic. This means that information travels in a single direction reducing the block time and energy consumption severely.

This makes staking Ada or other such currencies a far quicker prospect. We’ll cover the specifics of DAG in a future article, showing off why it works the way it does. All you need to know is that newer DAG transaction systems offer thousands of transactions a second, which is leaps and bounds higher than Bitcoin.

Decentralised Finance Projects & Other Uses

Here, we hope to highlight some of blockchain’s practical applications. The digital distributed ledgers have uses outside of purely decentralising currency exchange. A lot of these systems use different types of decentralised ledger technologies.

Particularly when it comes to industries and data security, a body of data implies that lack of data transparency and over-reliance on centralised databases is a major issue. Modern digital ledgers can help solve such problems and balance transparency concerns where possible. They can also open the door to far better cyber-security.

A lot of these new applications are fairly new and some are still in the development phase. Keeping this in mind, one must assess them with an open mind but also view them as works in progress. Furthermore, who knows whether such a system will be replaced by something better or a new generational advancement within blockchain?

Blockchain Financial Services Use Cases

Finance has been the major beneficiary of blockchain and distributed ledger technologies. As a means of transferring info, we’ve already covered the main draws it provides. Many different players within the digital finance industry have been making headway using the technologies we’ve outlined above.

Blockchain enthusiasts have been insisting that digital ledgers can solve a lot of the transaction and data trust issues within the financial services industry. The idea is novel, and certain cases like that of banks like ING are indicative of quite some promise.

ING and Credit Suisse conducted the first-ever live securities trade on a blockchain platform. Both banks were thus able to swap EUR 25 million worth of high-quality liquid assets. This was part of a collateral lending application of fintech HQLAx on R3’s Corda distributed ledger platform. Such a program was able to help them meet new liquidity requirements and convert them to cash with ease.

“What’s really different is that it gives the regulator the opportunity to get direct access to the ledger and see the entire digital history of the transaction, from where it originated to its ownership and attributes. In the over-the-counter environment, which is traditionally not that transparent, it could make the entire financial system more resilient,”

– says Ivar Wiersma, head of Wholesale Banking Innovation at ING.

Blockchain Inventory Management

Blockchain provides an unprecedented level of accessibility, security, and accountability. It’s no surprise that this has made the technology viable for inventory solutions. Warehouses, transport companies, mail carriers, etc., can all benefit by leveraging decentralised systems. Particularly when it comes to conducting operations requiring high numbers of clientele, blockchain helps maintain anonymity and fairness.

Much like the decentralised finance case, blockchain allows entities such as warehouses, manufacturers, suppliers, production sites, distribution centres, and retail partners to connect to each other through a permanent record of every transaction. All the records are then stored and accessible to everyone within the network.

One such example has been IBM and the Abu Dhabi Oil Company’s blockchain supply chain system pilot program. Their new setup is letting them track oil straight from extraction to customers. Along the way, it simultaneously automates transactions, reduces costs, and lowers hurdles associated with shipping.

While the process is in its relative infancy, Blockchain has also made waves in warehousing. It comes in handy for inventory management, transportation tracking, logistics, and data authentication for security. The world’s largest diamond producer (De Beers) is applying blockchain as a step in ending the sale of blood diamonds. Their Tracr app ensures that no foul play occurred in the supply chain for the jewels they procure.

Blockchain Insurance Use Cases

Insurance could benefit widely from a number of Industry 4.0 innovations. Particularly, when it comes to asset tracing, security, and transparency, ERP integration with blockchain can be of great benefit. Blockchain-based Enterprise Resource Planning can be a great avenue in the insurance industry, allowing an open-ended autonomous network to deliberate laborious calculations.

According to a report by ConsenSys, 46% of insurers expect to integrate blockchain in the next two years. Additionally, another 84% of insurers identify that blockchain and smart contracts could “revolutionise the way that they engage with new partners”. Simply put, insurance companies have already been looking into these possibilities.

Similarly, the Blockchain Insurance Industry Initiative (B3i) was formed in 2017. This was a group of Europe’s high-profile insurance and reinsurance companies, including Aegon, AIG, Allianz, Munich Re, and Swiss Re. With over 40 companies as stakeholders, B3i has endeavoured to put together a smart contract system.

It offers insurance for property catastrophe excess-of-loss reinsurance that rapidly reconciles accounts between an insurer and its reinsurers with minimum redundancy or latency. Following an event, payouts are automatically calculated for affected parties. Such automation frees up crucial resources and saves time for both parties.

Cryptocurrency Growth Potential

As the use cases show, there is immense interest in multiple sectors. Cryptocurrencies are still the main use of blockchain, but we’re seeing a lot of entrants into the market. As an evolving technology, there will always be reiterations, improvements, failures, and successes.

If one makes a note of the trends in decentralised finance news reporting, there’s a lot of buzz about the booms and busts of the market. If current trends are any indicator, 3rd generation cryptocurrencies are the ones to look out for.

HOWEVER, this comes with a caveat: apparently, no other currency has yet been able to achieve the intricacy of Bitcoin’s networks. This gives it an unprecedented level of security. That said, it lags behind in various other features (most notably scalability). Additionally, Cardano is touting that their Ouroboros blockchain protocol can go toe-to-toe with Bitcoin’s security guarantees.

There are thousands of cryptocurrencies out there and the market is growing. A while ago, Ethereum was thought to be overtaking Bitcoin, but now currencies like Cardano are being pushed as the “Ethereum-killer”.

In summary, the growth potential is boundless but there will be winners and losers in this market. Invest wisely.

Next Article: we’ll cover the basics of staking, cryptocurrency valuation, and how to start trading Bitcoin for beginners.

2 Replies to “What is Defi: Decentralised Finance & Blockchain Explained”

Cryptocurrency 101: Staking & Stake Pools - Promoguy

April 15, 2021

[…] the baton from our previous article, we’re going to get into the nitty gritty of cryptocurrency. This time we’re talking […]

ADA Staking Pool Management For Beginners - Promoguy

May 4, 2021

[…] that we’ve covered the basics of Blockchain, DeFi, and staking pools, we’re going to give you the rundown of how to start staking ADA and […]

Comments are closed.